This Current Bitcoin Cycle Could Look a lot Like 2013

Bitcoin has only seen one intra-bull market correction of 50%+ in its history. 2021 could be setting up for a repeat.

Cody Garrison | 7/20/2021

We’ve written before on the cyclical nature of the cryptocurrency markets and how sudden, volatile movements (up or down) like what we’ve seen over the past few months are nothing new, and actually a predictable feature of the macro adoption cycles.

Referring back to charts and market dynamics present in 2013, one can’t help but notice the parallels to the current state of the markets in 2021. At Clearblock, we don’t see this as a mere coincidence.

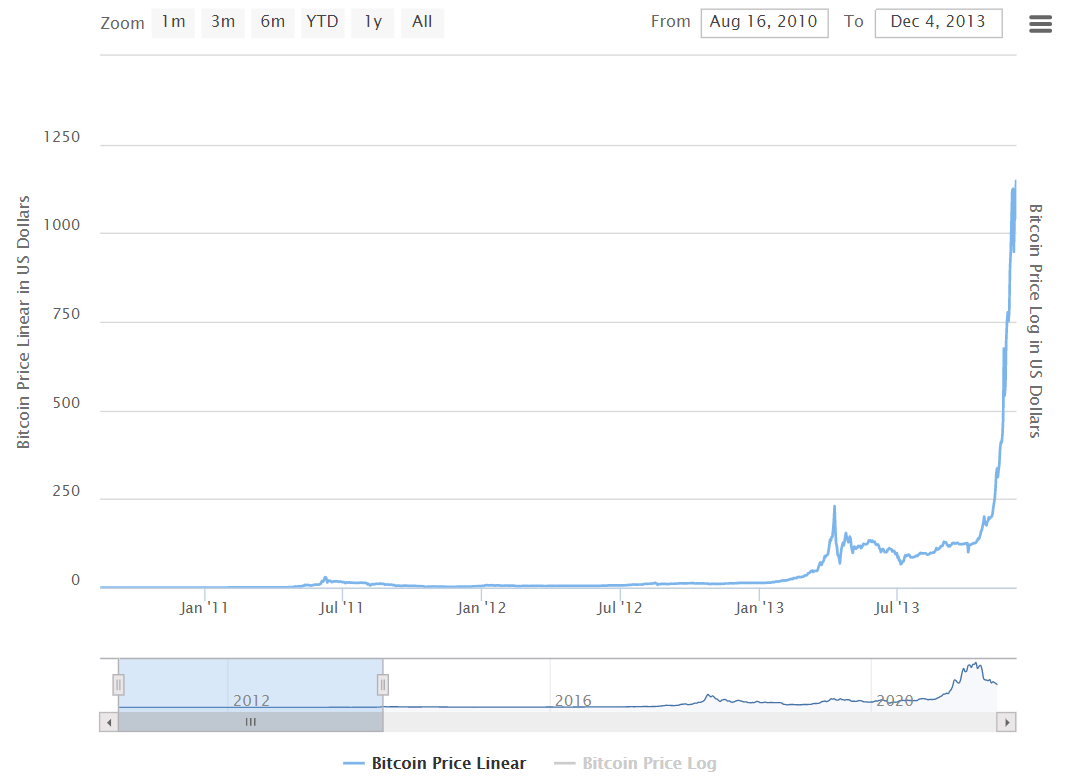

Chart 1. Bitcoin’s chart in 2013 looks nearly identical to its chart today. But remains just a blip in it’s history when you zoom out.

A New Investing Cohort Emerges

Following it’s multi-year bear market cycle from mid-2011 through late-2012, Bitcoin and the broader cryptocurrency markets entered a steep uptrend in the first half of 2013. Driven by the emergences of popular exchanges and marketplaces used to buy, sell and trade cryptocurrency for goods and services for the first time on the internet, a new cohort was brought into the market - the Early Adopter. The move from simply innovators building and dabbling in a new space quickly grew into a much larger audience from more diverse backgrounds, professionally and culturally. From accountants and college students playing video games on the weekend and trading digital products via message boards for Bitcoin, to dark web buyers and sellers trafficking in elicit products for that same Bitcoin, cryptocurrency underwent it’s first mainstream push. This was driven by increased users and trading volume. The price followed before stalling out in summer after an exhausting move up. Doesn’t this sound familiar?

Chart 2. Bitcoin price from August 16 2010 - July 23, 2013. Its move from late-2012 into Summer 2013 mimics 2021.

This shift from Innovators to Early Adopters in 2013 brought a colossal wave of new interest and cash into the marketplace - a whole new cohort entered the space that would soon dwarf the original builders and innovators across all metrics of capital, volume, and broad market participation. Though still in its infancy, this paradigm shift marked a clear line in the stand for a new era of market maturity.

We saw the same phenomena during the first half of 2021. Major institutional participation in the markets once again ushered in a paradigm shift from retail traders and investors, everyday people around the globe on a number of public exchanges to asset managers, ultra-wealthy investors, and corporations flooding the market— a shift that once again dwarfed the previous cohort across capital inflows, volume, and publicity.

Builders Keep Building. Traders Keep Trading.

While the price of Bitcoin fell following its sharp move higher in 2013, those in the industry noticed a disconnect between the price of the asset sinking and the ever growing interest in the space. Platforms like Reddit, Twitter and BitcoinTalk.org showed tremendous upticks in discussion around Bitcoin, and emerging exchanges and marketplaces including Mt. Gox, Silk Road and LocalBitcoins saw volume proportionately rise.

It was clear that builders kept building, traders kept trading, and investors kept stacking.

A very similar phenomena is at play today. As the price of Bitcoin has corrected more than 50% from it’s highs, retail interest continues to grow at a compounding rate, with on-chain metrics showing new Bitcoin entities holding < 1 Bitcoin hitting new all-time high last week, while whales are once again accumulating vast amounts of Bitcoin.

Following the correction in 2013 that would’ve made those unaccustomed to the hyper-volatile nature of crypto shake in their loafers, Bitcoin began another steep uptrend, one that would make the summer’s previous high, and subsequent sell off just a blip on the radar — a 10x increases off its Summer lows.

If a repeat of 2013 were to occur on a similar percentage basis, Bitcoin would surpass $250,000 by 2022!

Chart 2. Bitcoin’s price movement following summer 2013’s sell off

Final Thoughts

The coming months will be very telling if the 2021 market cycle will in fact follow in it’s entirety that of the 2013 cycle. While so far there has certainly been a correlation in the charts and market dynamics, massive capital inflows and mainstream catalysts will need to emerge in order to push the current price of Bitcoin ($29,400) by a whopping 1,000%. We’ve written about what those may look like here over a longer term, multi year period.

There is evidence that the time between Bitcoin cycle peaks and troughs are lengthening in time with each cycle. If that is the case, the price appreciation is unlikely to be as fast and aggressive as the wild west days of 2013. We do believe that Bitcoin will likely reach a new all-time high in Q4 of 2021, however, we don’t believe $250,000 is in play this year.

_____________________________

The views above are the opinions of the author and Clearblock Insights. They are not to be taken as investment advice. Thank you to Highcharts.com and Buybitcoinworldwide.com for the charts.