NFT's Are Supercharging The Ethereum Burn Rate — Why This Is Bullish

Cody Garrison | 8/15/2021

The much anticipated London Hard Fork has come and gone for Ethereum, which included Ethereum Improvement Proposal (EIP) 1559, an update that aims to change the way transaction fees, or “gas fees,” are estimated. Under EIP-1559 every transaction fee will be burned, or removed from circulation, which will begin to reduce the supply of ETH and potentially boost its price. Plain and simple, the more Ethereum transactions that occur over time, the less Ethereum will be available on the market. This is seen as a major step in Ethereum’s journey to becoming a truly deflationary asset and ultrasound money, completely contrary to the US Dollar’s 50 year old inflationary model that will likely cause a rash of economic issues in the future following global governments rabid money printing over the last 18 months in an effort to stimulate the Covid-economy. You can read more about the consequences here.

While it wasn’t clear ahead of the upgrade just how much ETH would be burned, as data begins to roll in, we are seeing evidence that the burn rate is even more substantial than many anticipated.

Source: Etherchain | The Block

As we approach the two week mark since the upgrade went live, we explore an unlikely source that is supercharging the ETH burn rate — NFT’s, or “non-fungible-tokens”.

NFTs Are Back

Just over a month ago the NFT bubble was deflated, with sales down ~ 90% from their Q1 highs, and many “experts” across the industry declaring the space as dead, a fad, and another over-hyped story within the broader crypto ecosystem. Yet if you were to look closely, you’d have seen this space was simply taking a breather, after an epic run up that saw the demand and hype cycle simply exceed the maturity of the infrastructure it was running on. We’ve seen this before with Bitcoin in 2017. If we learned anything from this, it’s that creators kept creating, builders kept building, and investors continued to pour capital into the development of the underlying infrastructure.

Then on July 20th, as the broader cryptomarket sunk to it’s lowest levels of the year, OpenSea, a marketplace to buy and sell NFTs (think eBay for NFTs) raised $100 million at a $1.5 billion valuation from one of the top venture capital firms across all of tech and crypto, a16z, known more broadly outside of Silicon Valley as Andreesson Horowitz. Since this funding round, OpenSea trading volume has absolutely exploded, up an astounding 76,240% year-to-date. The NFT marketplace processed 1.18 million transactions worth $1.06 billion in the last 30 days alone.

NFTs Feel the Burn

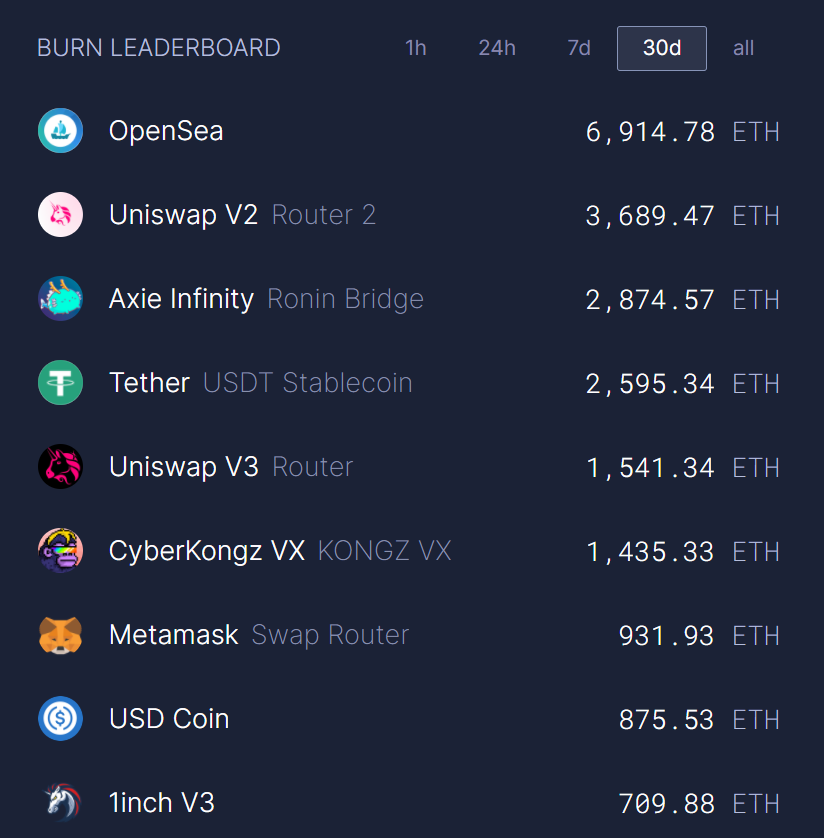

Seemingly each week a new project is thrust into the mainstream, each more quirky than the last. While the frenzy to buy, sell and trade six-figure .jpgs of digital penguins, apes, or even pet rocks may confuse many of you, including our team, it does have broader implications for the top projects on which they are built, such as Ethereum. In the 10 days since EIP-1559 went live, 50,000+ ETH has been burned, totaling more than $160 million. While few expected the burn rate to reach such substantial levels so quickly, even fewer predicated the source from which the burning would come from. NFT transactions through OpenSea have accounted for nearly 10% of all Ethereum burned so far and showing little sign of slowing down.

Source: ultrasound.money

Final Thoughts

NFTs are ushering in a new way of thinking about property ownership in the digital era. With younger generations spending as much as 70% of their waking days plugged into digital mediums, and the continued chatter of the emergence of a mainstream metaverse within the next decade, owning a piece of this digital world in it’s early days could be akin to acquiring land in Manhattan in the early 1800s, or California during the gold rush of the 1900s. The race to acquire these assets is firmly underway.

As we watch this phenomena play out, we can expect the NFT space to grow and evolve just as rapidly as the digital and crypto landscape around it. And as long as Ethereum is the predominant platform that NFTs are transacted on, we can expect a higher than expected burn rate for ETH with this rapidly growing use case taking a larger than ever expected piece of the on-chain transaction volumes.

A top competitor to Ethereum when it comes to NFT’s as well as DeFi is Solana, a web-scale blockchain that provides fast, secure, scalable, decentralized apps and marketplaces backed by some of the biggest power players in the industry. In application, this would allow transaction throughput to scale proportionally with network bandwidth satisfying all properties of a blockchain: scalability, security and decentralization. Solana (SOL), currently trading around $45 at the time of writing could see similar upside with sustained interest in NFTs, as fees to purchase and trade NFTs are currently much cheaper through Solana than it’s more established comp, Ethereum. We’ll be watching closely as more NFT projects emerge on Solana - especially if this weekend’s success of the Degenerate Ape Academy is any preview of where Solana-based NFTs might trend.

_____________________________

We’ll leave you with one fun conspiracy theory to think about: What if the recent NFT blitz is a coordinated effort by large ETH holders to burn as many tokens as possible post-EIP 1559 in order to pump their investments? While unlikely, it’s certainly one way to make ETH more scarce and in turn pump the price up.

_____________________________

The views above are the opinions of the author and Clearblock Insights. They are not to be taken as investment advice. If you’d like to dive deeper into the nuances of the London Hard Fork, and what it means for Ethereum, click here.