SEAL Index:

Can SEAL Become the FAANG of Web3 Infrastructure— as Ethereum, Solana, Avalanche and Terra Emerge as Potential Blue Chip Layer 1s?

Cody Garrison | 1/6/2022

The “Layer 1 Wars” have been a headlined topic over the last few months. With the emergence of competitors whose technology goes beyond just hype, for the first time we are seeing Ethereum face legitimate competition from the likes of Solana (SOL), Avalanche (AVAX), Terra (LUNA) and a few others whose DeFi ecosystems are coming into their own with an array of legitimate use cases. And it comes at a time where Ethereum’s fees have simply gotten too high for much of the general public to utilize the network.

A Layer-1 Blockchain protocol is a computing platform that allows decentralized infrastructure to be built. Layer 1’s are the pillars of Web3.0— across finance, media, entertainment, art and science.

In this report, we’ll briefly touch on the legacy Layer 1 protocol, Ethereum, as well as highlight the emerging players who claim to allow for a cheaper, more efficient foundation for a decentralized internet. We introduce the SEAL index - an index measuring the top Layer 1 protocol performance, akin to big tech’s FAANG index. Solana (SOL), Ethereum (ETH), Avalanche (AVAX) and Terra (LUNA) make up the index. We look forward to monitoring how SEAL performs vs BTC and other sectors in 2022 and beyond, and expect that Solana, Avalanche, and Terra all claim market share from the current dominance of Ethereum evidenced below.

Data sourced from https://defillama.com on 1/5/2021. Chart by Clearblock Insights

Ethereum (ETH): The First-Mover

[Market Cap: $405.5 billion | Price: $3,410 | Rank: 2]

Pros: Ethereum’s first mover advantage, with years of projects being built and scaled on the network, and thousands of active developers continuing to grow the ecosystem, it is a fact that ETH is engrained in fabrics of the broader crypto-economy. It is one of the only Layer 1 protocols to have proved multicycle staying power.

Cons: Due to competition over block space that comes with increased global usage of the network, current ETH fees are excessive for the general population, often costing hundreds of dollars to send a single transaction. The smaller block structure vs other competitive L1s and increases usage leads to a bidding war for space to confirm transactions. In addition to this, the delayed transition to Eth 2.0, an update to improved speed and throughput of the network by moving from PoW to PoS, has allowed competitors to capture market share over the last couple of years. We expect this trend to continue into 2022.

Ecosystem: Having a multi-year head start on it’s competition in the Index, the Ethereum ecosystem has built and continues to scale best in class infrastructure across the board— from wallets, DEXs, lending and borrowing protocols, NFT marketplaces and so much more.

Solana (SOL): The VC Powerhouse

[Market Cap: $45.9 billion | Price: $150 | Rank 5]

Pros: Due to Solana’s larger block structure (shown in the below chart vs ETH), the network allows for faster and more scalable transactions than it’s L1 competitor Ethereum. This also allows for exponentially lower fees than ETH, a benefit for retail and everyday investors utilizing the network making Solana somewhat of the “The People’s Blockchain”.

Sources: solana.com; ethereum.org

Cons: Solana has tremendous Venture Capital backing and ownership, which is a pro early in the growth process, but becomes a hinderance to broader decentralization down the line— if a few large entities were to have control of a large portion of the supply. There are fears in the community that these early VC investors will eventually realize profits and “dump their bags” on retail investors. It’s a valid concern and one to monitor as the ecosystem grows both organically and through continues venture backing.

The Solana network is built and operated on a separate ecosystem than Ethereum, and not compatible with it’s well-established infrastructure (Metamask, Aave, Curve, SushiSwap, etc.) to make transfers from Solana Defi wallets to Ethereum Defi wallets without a more complicated bridging process. As more and more users leave Ethereum to explore other L1 options, they may be attracted to Avalanche or Harmony that currently integrates with many formerly Ethereum-native protocols.

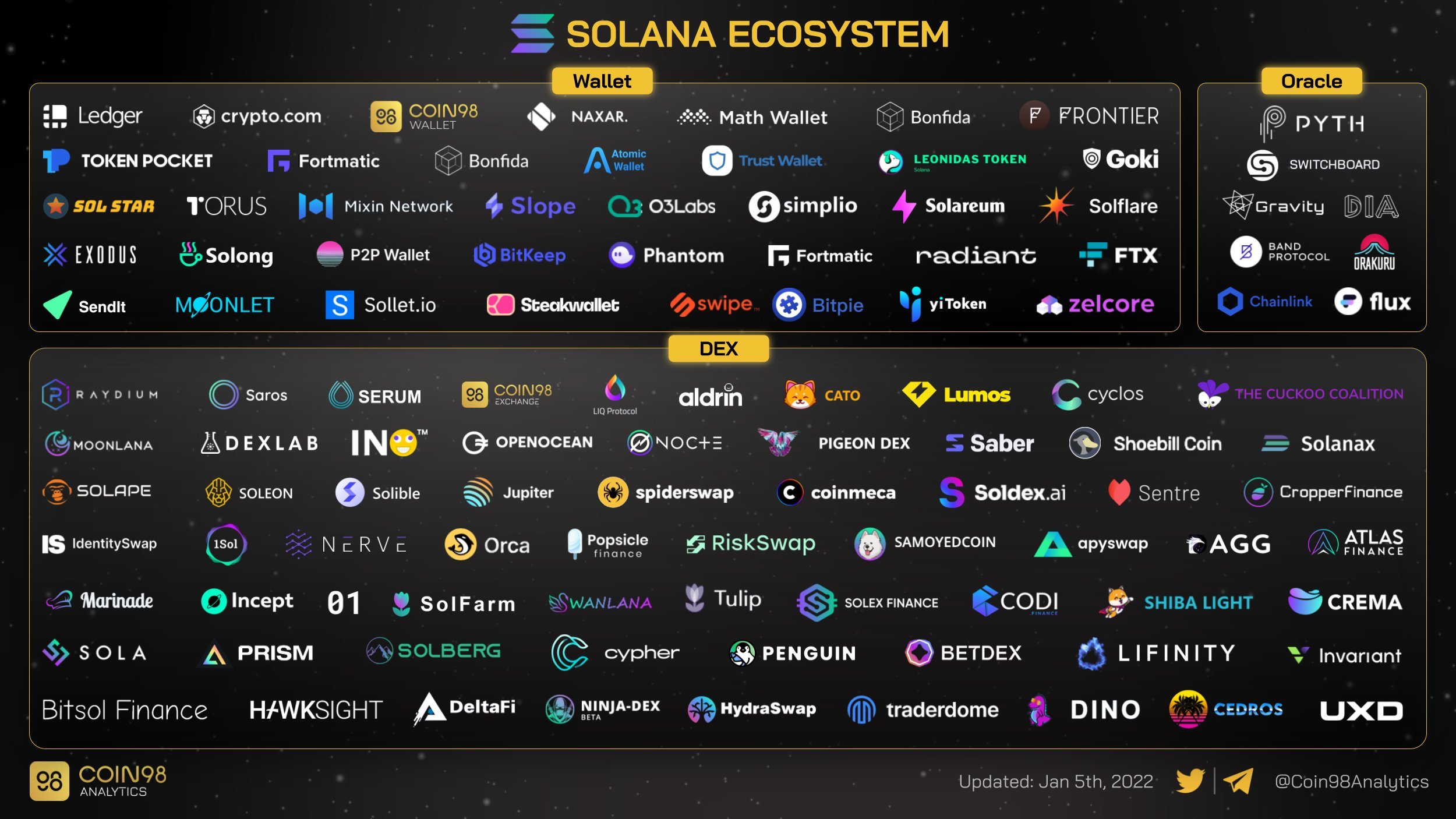

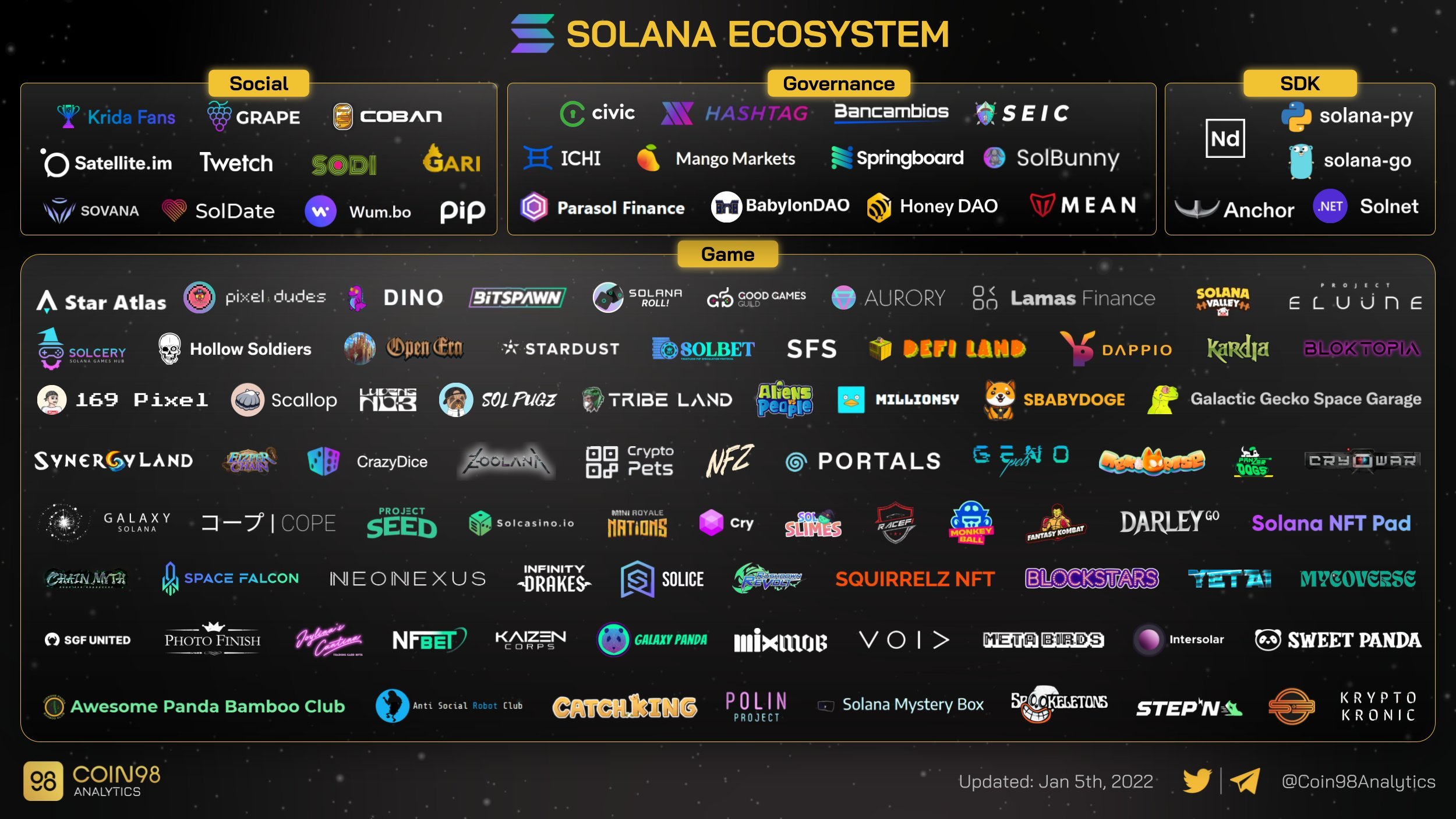

Ecosystem: Solana’s DeFi ecosystem has seen exponential growth in 2021, with expectations for it to continue into 2022. After launching in March 2021, Solana’s most popular wallet, Phantom, saw 200k downloads by July —> 1 million by November —> 1.8+ million by January 1. The Co-Founder said this week that he expects between 10 and 50 million by the end of 2022.

Avalanche (AVAX): New Kid on the Block

[Market Cap: $23.2 billion | Price: $95 | Rank: 11]

Pros: The Avalanche network allows users to operate on the Avalanche blockchain, via Ethereum’s DeFi protocols and hold AVAX and ecosystem tokens on your Metamask wallet. This allows current and former Ethereum users to operate on the on familiar protocols with significantly less fees. This also makes it much easier for users to bridge their assets from the Ethereum blockchain to the Avalanche blockchain, vs competitors like Solana which require more complex wrapping.

Cons: Like many L1 competitors to have emerged in 2020-2021, Avalanche has yet to prove multi-cycle staying power through the depth of a prolonged bear market. Under heavy usage in November 2021, the network saw fees skyrocket from $1.50 to over $20 in some instances— certainly something to monitor as adoption of the network continues to grow.

Ecosystem: The Avalanche DeFi ecosystem saw tremendous growth in October and into Q4 of 2021 for three major reasons, 1) Ethereum gas fees got out of hand leading many users to experiment with other L1 blockchains, 2) Use cases— infrastructure emerged with Trader Joe DEX and DeFi 2.0 gained popularity with Wonderland’s (TIME) insane APY, and 3) Continued inflows of venture capital from the likes of Three Arrows Capital and continued developer growth building on the protocol.

Terra (LUNA): The Late Bloomer

[Market Cap: $27.8 billion | Price: $78 | Rank: 9]

Pros: The Terra network has a number of unique projects that have contributed to it’s increased popularity in recent months. With Anchor Protocol allowing for a best in class DeFi lending and borrowing protocol, and Mirror Protocol allowing users to trade synthetic assets like stocks and public equities with crypto, in regions around the world that did not previously have access to these markets or assets. These unique protocols will likely contribute to Terra’s growing user base as they move deeper into Western markets.

Cons: Terra (LUNA) is most popular in South Korea and the greater Asian region with less of a presence in the West compared to it’s competitors in the Index. In addition the network only has about 130 validators securing the network, meaning significantly less decentralization from Ethereum’s 200,000+ and even Solana’s 1,000+ validators.

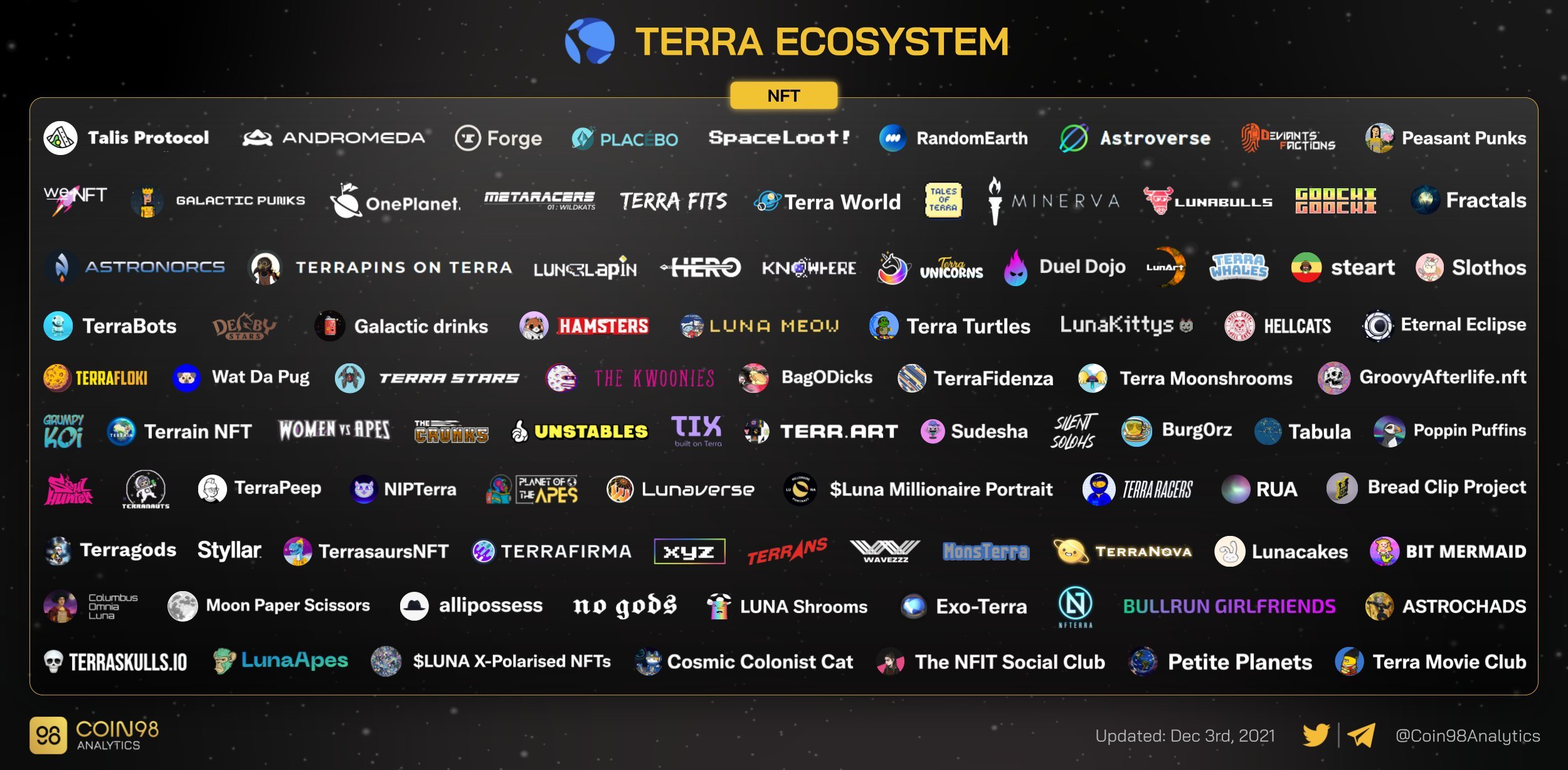

Ecosystem: A number of innovative and popular projects have emerged in the Terra ecosystem that have promoted it’s rise in popularity and TVL, with just a few of the most popular being: 1) Anchor Protocol allows users to stake their LUNA for upwards of 20% APY, 2) Mirror Protocol has built the creation of fungible assets, or “synthetics” that track the price of other real assets, and 3) integration with popular staking platform Lido Finance.

Outlook

We will live in a multichain environment with 3-5 mainstream L1s— not a winner-take-all, but a winners take most.

SEAL outperforms BTC over the next 18 months on the back of continued developer inflow and innovation in the ecosystems.

Investors continue to move down the L1 risk ladder— from ETH to SEAL, then down to FANO? (Fantom, Cosmos, Near, Harmony), but return to blue chip allocation under bear market pressures.

Honorable mention L1s to watch in 2022:

Near Protocol (NEAR) - a heavily VC backed protocol that utilizes sharding to enhance scaling— what could be considered a functioning version of ETH2.0.

Fantom (FTM) - emerging as another developer favorite, with dozens of protocols and over $5.7B TVL.

Cosmos (ATOM) - continues to attract developers to their ecosystem and maintain an role in tier 2 emerging L1s.

Harmony (ONE) - the growing popularity of DeFi Kingdoms, a play-to-earn game built on Harmony propels ONE into the L1 conversation.

Ethereum’s co-creators go rouge - Polkadot (DOT) and Cardano (ADA) still maintain investor followings and attract developers despite lagging behind other L1s in adoption metrics.

_____________________________

The views above are the opinions of the author and Clearblock Insights. They are not to be taken as investment advice.

[Disclosure: Clearblock employees own both ETH, SOL, AVAX, LUNA, DOT, ATOM, ONE and NEAR each mentioned above]