DEX Report: Q1 2023

A comprehensive overview and outlook of the DEX landscape

By: Cody Garrison | 2/10/2023

I. Product Mechanism & Comparison

A Decentralized Exchange, or DEX, allows users to buy, sell and trade an array of digital assets and tokens directly peer-to-peer without interacting with a centralized intermediary, but rather smart contracts. Since the onset of DeFi Summer in 2020, DEXs have dominated the landscape of DeFi. Perhaps the most crucial pieces of infrastructure in the web3 economy, DEXs acts as the center of trade, governance, and financial efficiency in our industry. To explore the current and future DEX landscape, we must first have a deeper understanding of the protocol mechanisms, tokenomic designs, and core differentiators of the current DEX stack.

AMM vs Orderbook

There are two distinct product mechanisms you will encounter when using a DEX. First, Automated Market Makers, or AMMs, are the most widely used type of DEX. They enable instant liquidity, democratize access to liquidity provisions and most importantly allow for the creation of permissionless markets for any token, rather than waiting for a CEX to jump through administrative or regulatory hurdles before listing your favorite new token. Holders can deposit tokens as liquidity into a smart contract and earn yield as an incentive for their services. Instead of a traditional order book, an AMM utilizes a smart contract-based liquidity pool that users can swap their tokens. with the price determined by an algorithm-based on the proportion of tokens in the pool. While this novel mechanism provides profound unlocks to a decentralized & economy and permissionless trading, there are downsides in that AMMs are seen by many as inadequate for true price discovery and don’t quite stand up yet to the needs of larger traditional finance behemoths who will ultimately bring industry-changing liquidity to the crypto markets.

On the other hand, order book DEXs offer a design mechanism more aligned with traditional market structure – a real time collection of open buy and sell orders in a market. In the case of an order book DEX, a willing buyer has to wait for their order to be matched with a seller. Even if the buyer posts their order to the “top” of the book within fractions of the current price, it may never execute given the spread. The bid-ask spread is the difference between the prices quoted for an immediate sale (ask) and an immediate purchase (bid). This spread is often displayed real time in the frontend of an order book DEX. Given every interaction within an order book must be posted on the blockchain, fully on-chain order book DEXs have been slow to gain traction on ETH given its limited tps. With continued innovation at the consensus and execution layers – L2s, alt-L1s and app-chains – on-chain order book DEXs are not only feasible, but continuing to eat at market share from established AMMs such as Uniswap, Balancer and PancakeSwap.

Aggregators

Another novel DEX product design is the aggregator model– a protocol mechanism that serves as a unified explorer for prices and liquidity. DEX aggregators have a single swap frontend that acts as a source liquidity from different DEXs on the backend, allowing users to capture better token swap rates than they could get on any single DEX. We’ll dig deeper into the competitive dynamic among the top DEX aggregators later in this report.

Tokenomics

The tokenomics of native DEX tokens are nuanced and differentiated depending on the protocol you're using. The most common type of tokenomic design for a DEX is through a Governance model. Holders of the native token can propose and vote on several predetermined aspects of the protocol, in the way internal company management would at the traditional levels, not limited to: voting on a set of protocol delegates, managing the funds held by the community treasury, implementing core changes to the protocols code or design, and deploying the protocol onto new chains. Governance action from the community can range from simply making a proposal in the open forum to be built out and implemented by a core engineering team (CAKE, OSMO, DYDX) to fully programmatic, decentralized on-chain proposals and code implementation via a time lock once approved by the community (UNI). In addition to the on-chain governance, Uniswap v3 has a protocol fee that can be switched on by a UNI governance vote. Most Governance tokens follow an inherently inflationary model to keep LPs incentivized. Voting power on governance proposals is almost always weighted 1:1 to the number of tokens held or delegated to a specific address.

In addition to pure governance, some native DEX tokens have adopted innovative design mechanisms to bootstrap liquidity or provide further incentives to holders. One example, seen with Sushiswap’s native token, SUSHI – was used as a liquidity incentive token to pull users from Uniswap. To start earning SUSHI tokens, anyone holding Uniswap LP tokens could stake those LP tokens into the corresponding initial list of pools. These users were paid in SUSHI for bootstrapping the initial liquidity on the network. While SUSHI is also the governance token of the protocol, it must be deposited into the SUSHI-ETH pool or staked in the SushiBar (for xSUSHI) to obtain voting rights. Similarly, Curve has adopted a dual-token model where CureDAO Token, CRV, is the protocol's liquidity incentive token that is rewarded to Curve LPs. The rewards incentivize deep liquidity pools that keep trading fees low, while veCRV is a utility-bearing governance token that is minted when CRV holders "vote-escrow" (time lock) their tokens. veCRV is the governance token of the protocol and can be used to increase LP rewards.

II. On-Chain Data

To understand just how large the DEX landscape has grown, and how much more room it has left, we must dig deeper into the data. The clearest way to tell a story and uncover hidden narratives in DeFi is to explore the on-chain metrics.

DEX vs CEX: CeFi Remains Dominant

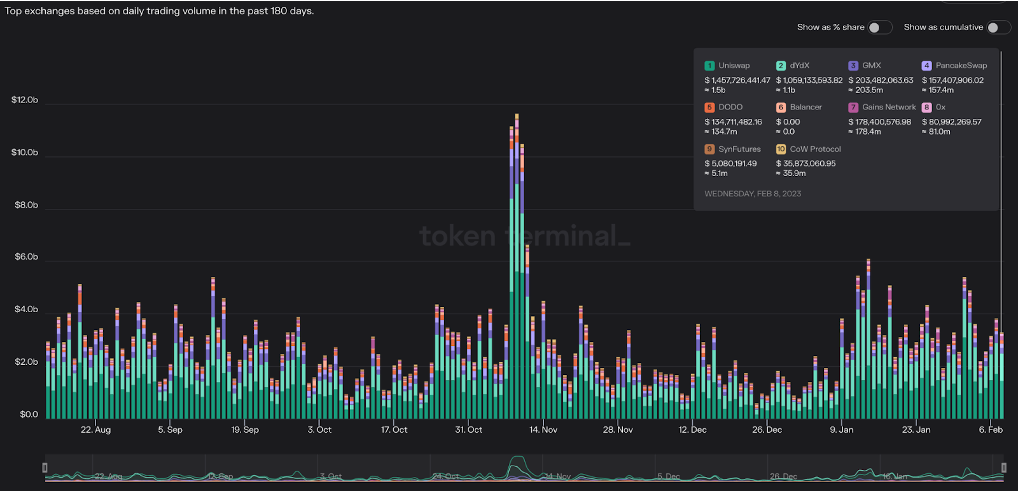

Despite the collapse of FTX, a top 3 global crypto exchange by volume, and a month over month surge in DEX volume in November 2022 evidenced by the chart below, the trend has failed to keep traction going into the new year. Binance has averaged ~ $20B in daily volume during the first week of February, where #2 Coinbase sat a factor of 10 below at just under $2B in daily volume. Uniswap led the way for the DEX category averaging daily volume around $1.2B. Taking another perspective, this similarly highlight just how much room DEX and the broader DeFi market have to grow.

[Increase in DEX activity show in November following FTX collapse]

DEX Usage by Trading Volume: EVM Holds the Crown

Evidenced by the below chart, the top three DEXs-by-Volume are deployed on EVM-compatible chains– Uniswap, dYdX and GMX, on Ethereum, Starkware, Arbitrum and Avalanche’s C-chain respectively capture > 75% of daily DEX volume in USD terms. PancakeSwap, the de facto DEX on BNB Chain, sits at #4 with nearly 1/10 the daily volume of Uniswap, perhaps a testament to the regional market dominance of Binance’s centralized exchange across APAC and MENA.

(Source: Token Terminal | February 9, 2023)

DEX by Unique Users: Pancakes For the People

One interesting story that the on-chain data tells is that despite daily trading volume dominating on EVM chains – PancakeSwap holds a strong lead in terms of daily active users.

(Source: Token Terminal | February 9, 2023)

To better understand the above phenomena we can look off-chain momentarily at high level socioeconomic demographics. The APAC region, which utilizes BNB Chain at a higher rate than Ethereum and L2s has an outsized cohort of individuals trading and participating in crypto than in North America. In addition to more net users, these users on a median basis hold far less wealth than their North American, EVM-centric counterparts. This likely explains the more users, but less daily volume paradox.

(Source: World Bank data | 2022)

TVL

Total Locked Value, or TVL, is perhaps the most recognized and regarded metric for valuing a DeFi protocol. While its merits can be debated, it is still a defining on-chain data point that our industry uses to measure a protocol's health, much like the Price-to-Earnings (PE) Ratio in TradFi equities.

DEXs are the leading aggregate category of TVL across protocols in our industry, showcasing that they are the defining pillar that allows the open economy to function at scale.

(Source: DeFi Llama | February 9, 2023)

The below shows an overview of TVL by DEX, highlighting that the Top 5 are all deployed on Ethereum and EVM-compatible chains.

(Source: DeFi Llama | February 9, 2023)

Protocol Revenue

Uniswap still dominates protocol revenue at the AMM level, while GMX has rocketed past first-mover dYdX for daily revenue, likely as a result of the unique fee split between both LPs (who receive 70%) and GMX token holders (30%). DEXs are one of the few DeFi products to have found enduring product-market fit. Marketplaces in tend to be good investments given they have a solid revenue generating model and opportunity to flick on a fee switch to have value accrue to the users in a more decentralized ethos.

(Source: Token Terminal | February 12, 2023)

III. Competitive Analysis

Uniswap vs PancakeSwap

Uniswap and PancakeSwap are two leading DEX primitives on two of the leading L1 blockchains – Ethereum and BNB Chain. While it was previously highlighted that Uniswap captures the most daily trading volume, BSC holds the crown for most DAU, below is a chart showcasing a number of other key differentiators between the protocols.

(Sources: Coinmarketcap, DefiLlama, Uniswap and PancakeSwap Docs | February 9, 2023)

Curve

Curve debuted a completely novel DEX primitive to the industry with the launch of its stableswap. Curve differs from Uniswap and PancakeSwap given it is a DEX exclusively for swapping stablecoins, with its most prominent pool - the 3pool - allowing for DAI, USDC, and USDT swaps. The success of Curve demonstrates the overarching value and importance of decentralized stablecoins by garnering $4.83B in TVL (as of February 9, 2023), the most of any DEX, beating out Uniswap ($3.9B) by nearly $1B.

Aggregators

Highlighted earlier in this report, DEX aggregators can be a useful tool for users to capture the best swap pricing across DEXs. However, despite offering inherently better trade pricing for the user than a single silo’d DEX, significantly more volume flows directly through the Uniswap and PancakeSwap front ends, highlighting the strong network effects that these protocols have built over the last couple of years. The first mover in the category and top aggregator by volume handled just under $214M in volume (February 8, 2023), nearly ⅕ the volume of leading AMM DEX, Uniswap and popular order book DEX, dYdX each sitting with > $1B.

[ Note: that Matcha trades go through 0x API so numbers below are not mutually exclusive ]

(Source: Dune @hagaetc / DEX Aggregator by Volume| data updated February 9, 2023)

While it makes up a significantly smaller proportion of total volume, the leading DEX aggregator on Solana, Jupiter Aggregator has 197 markets and averages just a hair under $22M daily volume [Source: Coinmarketcap | February 8, 2023] .

Forks

With open source code comes a naturally hyper competitive arena of development. Showcased by the phenomena of ‘Forks’, or taking existing open-source code, copying it, and making a small change in the form of increasing block size to allow for higher throughput, or a nuanced community direction not approved by the broader protocol. This is most notorious with Sushiswap forking from Uniswap during DeFi Summer in 2020. Despite Uniswap remaining atop the mountain in terms of average daily volume, market cap and TVL, Sushi has built an enduring brand & community and remains a top 5 DEX by virtually every metric. It also continues to innovate in a different direction than its Uniswap roots, over time becoming a completely differentiated protocol in its own right.

IV. Investment Thesis

Entering the next cycle it's important to understand that narratives and innovation will look much different than the last, just as they did from Summer 2017 vs Summer 2020 - and likely again in Summer 2023. With the onset of DeFi summer in 2020, the compounding need for innovation trading and incentivization layer grew exponentially. Primitives across trading, lending, borrowing, and community governance took center-stage. While DEX investments become a saturated vertical throughout late 2021 through 2022 in terms of VC funding and competition with several protocols looking much like the next with different branding on a different chain, I firmly believe innovation at the scalability layer is not yet near its endgame, and now is not the time to be complacent with the establish brand-name protocols.

[Chart displays saturated VC investments into DEXs during H2 2022]

(Source: Messari x Dove Metrics Fundraising Report | August 8, 2022)

Overall, I believe it is well worth continued investment into the DEX vertical – although not into the same primitives or forks of what we’ve already seen brought to market. In addition to the overarching trend around broader adoption of decentralized platforms, there are two distinct arenas in which new DEXs will grab market share and not only be leading investments in the portfolio but help define the next phase of growth for our industry:

1) Innovation at the Scalability Layer

In a short period of time we have seen throughput increase ten fold in DeFi. With Ethereum handling ~15 TPS, BNB Chain building on 50 TPS, L2s, App-chains, and Solana scaling up anywhere from 500-6,000 TPS, and now Aptos and Sui marketing as 100k+ TPS in testnet – we are entering a new frontier of web scale infrastructure. This next-gen infrastructure will support DEX primitives that begin to look more and more like TradFi trading platforms. Lower latency will lead to tighter spreads and larger players entering the fold as market makers and active traders.

I firmly believe that scaling the EVM is one of the highest leveraged uses of capital, time and developer talent in this bear market. With this in mind, Monad, a new EVM-compatible L1 that claims 10k TPS will be interesting to watch. If a fully on-chain order book DEX can be deployed on this chain, I can see eventually not only overtaking a dYdX app-chain, but competing side by side with Uniswap. This technology would allow for the unlock of a new level of price discovery not currently available on an AMM. I am also keenly looking into similar on-chain order books being built with the Move programming language – either on Aptos or Sui leveraging 100k+ TPS. An era of web scale innovation is coming, and order book DEXs will demonstrate their proof of concept to the world.

2) The DeFi Mullet: CeFi in the front, DeFi in the back

I see a tremendous amount of value capture in a DEX that can leverage a hybrid CeFi x DeFi model. While it sounds paradoxical at first glance, it is clear the United States and many western countries are entering a period where the regulatory hammer is about to drop in our industry. If projects are able to leverage innovation with multi sigs, I can imagine a new, polarizing CeDeFi DEX concept to capture market share among larger, compliant players. I would be looking closely at a DEX that leverages a decentralized backend infrastructure with a KYC/AML frontend where user funds are held in a two-party multi-sig– the user holds half their keys and the exchange entity holds the other half if an effort to get ahead of pending regulatory crackdowns. The exchange would not be able to do anything with the user funds without their signed transactional approval, while the user can leverage all the innovation that first-gen fully non-custodial DeFi offers without being beholden to a third party intermediary. dYdX moving from Starkware to as Cosmos app-chain is likely a regulatory strategy to take itself off an L2 with centralized sequencer concerns and to a more sovereign app-chain environment. Especially given its operating a perps exchange in a region where that type of trading is currently banned.

Simply investing in more capital into AMMs that compete with Uniswap and PancakeSwap is not a high leverage use of capital, rather we need to look at net new innovations around scalability, throughput latency, and user experience in 2023 and beyond.

V. Key Innovations & Sector Outlook

We’ve discussed in depth the first movers in the DEX vertical with chain-specific AMMs, and touched on the nascent innovation in scalability that has allowed order book DEXs to gain momentum. I believe liquidity will consolidate deeper to a set of core winners on each chain who are already beginning to show themselves– Uniswap most clearly, along with a couple that have yet to emerge.

A key trend going forward for DEXs will be their abstraction from the application layer. Rather than users simply visiting app.uniswap.org or pancake.finance, an array of applications across gaming, finance, and social commerce can leverage the composable DEX primitives as pillars for white labeled in-app economies. This will bring more users, deeper liquidity, and higher volumes to the protocols completely abstracted from the user experience.

Another clear and expanding use case for DEXs are the financialization of non-fungible tokens and assets. NFT aggregators allow users to buy multiple NFTs from multiple exchanges in one transaction, saving on gas and time. Gem, Blur, x2y2 are a few of the primitives in this vertical that are gaining market share on dominant first-gen marketplace such as Opensea and LooksRare evidenced in the chart below.

(Source: Dune | February 8, 2023)

In addition to NFT aggregators, NFT AMMs have burst onto the scene with SudoSwap. This broader financialization of NFTs is going to continue to evolve going into the next cycle. Where the ICO bubble in 2017 is seen as DeFi 1.0 and the precursor to DeFi Summer and the enduring multi-billion dollar DeFi 2.0 sector we have today, the NFT 1.0 jpeg bubble of 2021 will be the precursor to a broader and much different financialization of non-fungible assets – we’ll call it NFT 2.0 in the near future.

It’s clear that the next frontier of DEXs will continue to be built on infrastructure that pushes the boundaries of scale– Aptos and Sui via the Move Virtual Machine, Cosmos app-chains, a hyper-scaled EVM L1 or L2, and the deeper financialization of NFTs & real world assets (RWAs) in a way that looks completely different than last cycle. DEXs will continue to be strong revenue-generating vehicles in the decentralized economy.

Innovation around scalability, regulatory compliance, and asset financialization will be defining moments for DEXs and the broader DeFi sector next cycle. Not only will these innovations be key to ushering in the next bull run, they will be seen as defining pillars of the industry going forward.

Sources:

Disclaimer: The views and opinions expressed in this report are not to be taken as investment advice or fact by any party. This report was written by Clearblock Labs for distribution to Binance Labs.